Necessary Actions for Effective Credit Repair You Required to Know

Wiki Article

How Credit Scores Repair Service Works to Remove Errors and Increase Your Creditworthiness

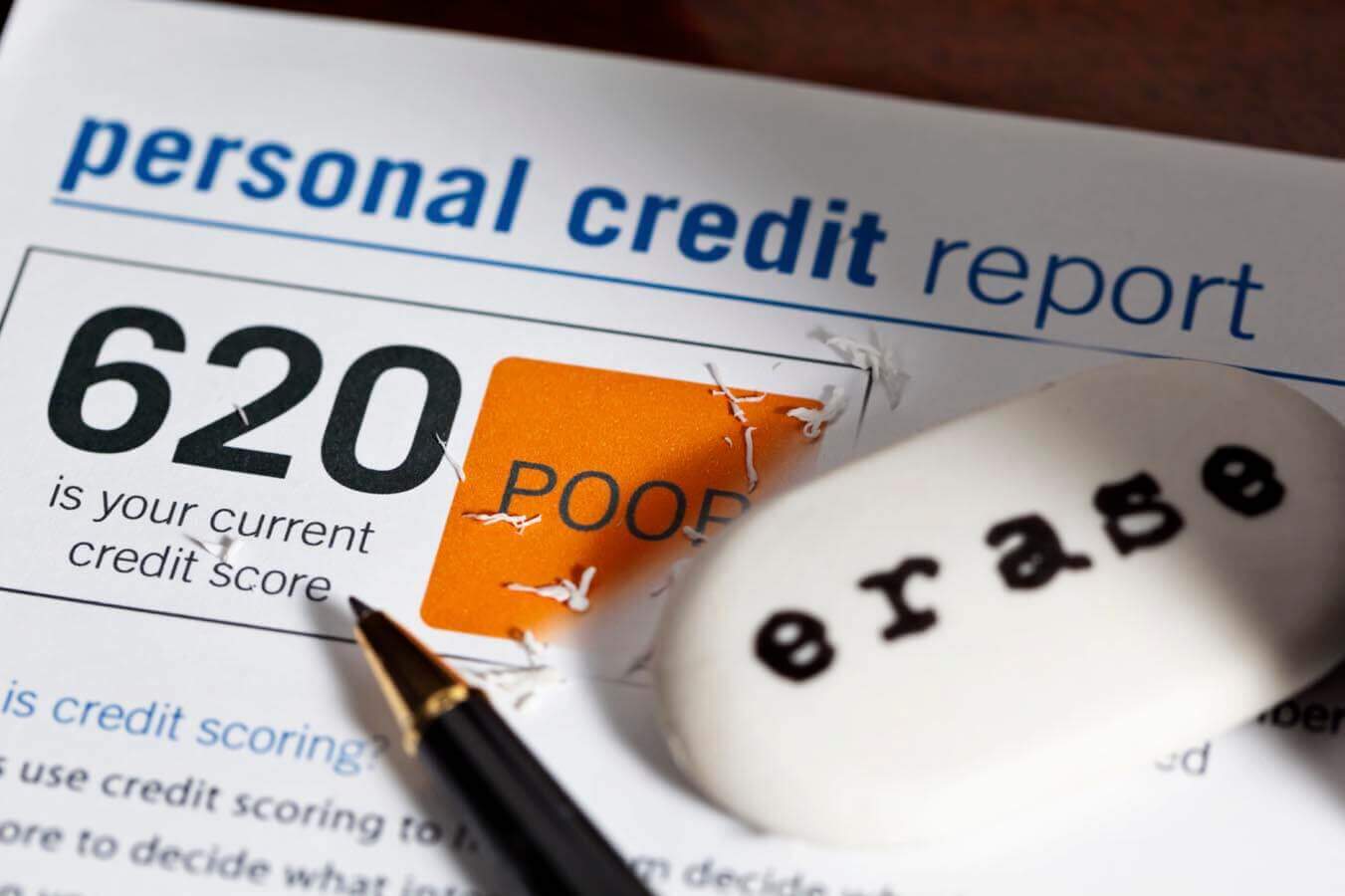

Credit rating repair work is a critical procedure for individuals looking for to improve their creditworthiness by dealing with inaccuracies that may endanger their economic standing. By diligently checking out debt reports for usual mistakes-- such as incorrect personal information or misreported repayment histories-- people can initiate an organized conflict process with credit report bureaus.Recognizing Credit Score Information

Credit report records serve as a financial photo of an individual's credit background, describing their borrowing and settlement habits. These records are compiled by credit bureaus and include critical details such as credit scores accounts, arrearages, settlement history, and public documents like liens or personal bankruptcies. Banks use this data to analyze an individual's creditworthiness when looking for loans, bank card, or home mortgages.A credit score report normally includes individual information, consisting of the person's name, address, and Social Safety and security number, together with a checklist of charge account, their standing, and any type of late payments. The report likewise details credit score inquiries-- instances where loan providers have accessed the record for assessment functions. Each of these elements plays an important duty in determining a debt score, which is a mathematical representation of creditworthiness.

Understanding credit reports is necessary for customers intending to handle their financial health effectively. By frequently assessing their reports, individuals can make certain that their credit report accurately shows their monetary actions, therefore positioning themselves positively in future borrowing ventures. Understanding of the components of one's credit score report is the very first step toward successful credit repair and total financial well-being.

Usual Credit Record Mistakes

Mistakes within credit report records can substantially influence an individual's credit history score and overall financial wellness. Typical credit history record mistakes include wrong individual info, such as incorrect addresses or misspelled names. These inconsistencies can result in confusion and might affect the analysis of credit reliability.One more constant error entails accounts that do not come from the person, frequently arising from identity theft or imprecise data entrance by creditors. Mixed data, where someone's credit rating info is combined with one more's, can additionally occur, particularly with people who share similar names.

Furthermore, late payments might be improperly reported because of refining misunderstandings or mistakes concerning repayment days. Accounts that have been settled or paid off may still show up as exceptional, additional making complex an individual's credit rating account.

In addition, inaccuracies concerning credit report limits and account balances can misrepresent a customer's credit history application proportion, a crucial consider credit report. Identifying these mistakes is vital, as they can bring about greater rate of interest, financing denials, and increased problem in getting credit history. Consistently assessing one's credit report is a proactive step to recognize and rectify these common mistakes, hence guarding financial wellness.

The Debt Repair Refine

Browsing the credit repair work procedure can be an overwhelming job for lots of people seeking to improve their economic standing. The trip starts with obtaining a detailed debt record from all 3 significant credit score bureaus: Equifax, Experian, and TransUnion. Credit Repair. This allows customers to determine and understand the elements affecting their credit ratingOnce the credit scores report is assessed, individuals need to classify the info into precise, inaccurate, and unverifiable things. Exact information must be kept, while mistakes can be objected to. It is necessary to gather sustaining paperwork to corroborate any kind of claims of mistake.

Next, people can choose to either manage the procedure separately or enlist the assistance of specialist debt fixing services. Credit Repair. Specialists frequently have the knowledge and resources to browse the intricacies of credit scores coverage laws and can enhance the procedure

Throughout the credit scores repair service process, keeping prompt settlements on existing accounts is crucial. This demonstrates accountable monetary habits and can favorably impact credit scores. Ultimately, the credit report repair procedure is an organized technique to determining issues, contesting mistakes, and promoting healthier monetary routines, resulting in improved credit reliability over time.

Disputing Inaccuracies Effectively

An effective disagreement procedure is crucial for those wanting to remedy errors on their credit reports. The very first step includes getting a duplicate of your credit rating report from the major credit score bureaus-- Equifax, Experian, and TransUnion. Review the report thoroughly for any kind of inconsistencies, such as wrong account details, dated info, or deceitful entries.When mistakes are recognized, it is important to collect sustaining documentation that look these up substantiates your cases. This might include settlement invoices, bank statements, or any relevant correspondence. Next, start the conflict process by getting in touch with the credit history bureau that released the record. This can normally be done online, through mail, or over the phone. When submitting your dispute, give a clear description of the error, in addition to the sustaining evidence.

Benefits of Credit Score Repair Work

A multitude of benefits comes with the process of credit history repair service, substantially impacting both monetary security and general high quality of life. One of the main advantages is the potential for enhanced credit history. As mistakes and mistakes are corrected, individuals can experience a significant boost in their creditworthiness, which straight affects loan authorization rates and passion terms.Furthermore, credit score repair work can enhance access to favorable funding options. Individuals with higher credit rating are most likely to qualify for reduced rate of interest on mortgages, automobile car loans, and individual fundings, ultimately causing significant financial savings with time. This better financial versatility can promote major life decisions, such as buying a home or investing in education and learning.

In addition, a healthy and balanced credit rating account can enhance confidence in financial decision-making. With a clearer understanding of their debt situation, individuals can make educated selections regarding credit score usage and administration. Credit rating repair work typically includes education on financial literacy, empowering individuals to adopt better investing practices and keep their credit find health lasting. In summary, the advantages of credit rating repair service expand past mere score enhancement, adding to an extra safe and secure and thriving financial future.

Conclusion

To conclude, debt fixing acts as a vital system for enhancing credit reliability by attending to inaccuracies within debt reports. The organized identification and disagreement of errors can bring about considerable improvements in credit ratings, thereby helping with accessibility to far better financing choices. By recognizing the subtleties of credit history records and employing efficient conflict approaches, individuals can accomplish higher economic health and wellness and security. Ultimately, the credit click fixing process plays a crucial function in fostering educated financial decision-making and long-lasting financial wellness.By meticulously examining credit history reports for usual errors-- such as wrong individual details or misreported settlement backgrounds-- people can start an organized conflict process with credit scores bureaus.Credit history reports serve as a monetary picture of a person's credit rating history, detailing their borrowing and repayment actions. Understanding of the contents of one's debt record is the first action toward effective debt repair service and general economic wellness.

Mistakes within credit rating records can substantially impact a person's credit report score and total monetary health.Additionally, errors relating to credit history restrictions and account equilibriums can misstate a consumer's credit use proportion, an essential factor in credit score scoring.

Report this wiki page